SUMMARY

- Since Bitcoin’s inception, blockchain technology has radically transformed finance.

- However, none of the new-world benefits of Decentralized Finance (DeFi) may be sustained without adherence to evolving regulatory standards.

- Civic CEO Chris Hart explores the past, present and future of DeFi.

In banks we trust(ed)

Not long ago, when someone talked about finance, there was no need to qualify what type of finance they were referring to. Centralized Finance, CeFi now, was the only option. This was true not because innovative ideas were lacking, but because large, central, state-sponsored or legacy financial institutions held all the cards.

The structural friction and inherent inequities controlling financial systems resisted the standing up of a new bank, exchange or regulated entity, and prevented all but the most advantaged institutions from participating in anything other than a transactional relationship.

For example, when you look at securities trading in the US, most exchanges are owned by a precious few companies, including the Intercontinental Exchange, which is the NYSE’s parent company, Cboe Global Markets or Nasdaq.

To be sure, there are a few upstart new entrants in the last couple of years, but mostly the exchanges have changed little in the past couple of decades.

But blockchain and crypto change all that, don’t they?

With the advent of blockchain and crypto currencies, what is striking is how much has changed, and how so many things still remain the same.

In centralized crypto exchanges (CEX), as in traditional finance (TradFi), enforcement of regulatory compliance rules like Know Your Customer (KYC) and Anti Money Laundering (AML), and the structural friction inherent in the granting process of licenses are the mechanisms by which winners and losers have emerged. And with that, the emergence of CeFi for the crypto world has largely occurred.

A few large crypto institutions hosting central limit order books, lending and other financial services now cater to millions of users worldwide.

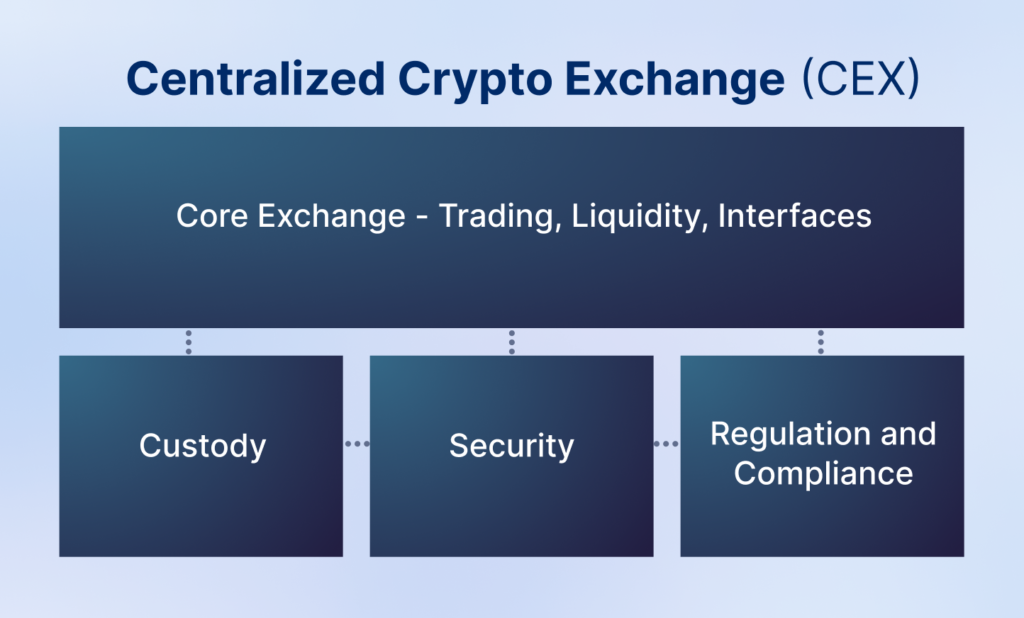

In effect, CeFi for crypto took the legacy exchange model, albeit with the addition of broker functionalities and removal of the need for clearinghouses, and rebooted it for a new asset class:

Disintermediation of finance: why are we walking but not yet running?

In many ways, the blockchain developments of the last 13 years have rewritten the rulebook, enabling permissionless innovation of Decentralized Exchanges (DEXs) such as Automated Market Makers (AMMs) and decentralized central limit order books, Lending Protocols, and the advent of DeFi in general. These products and services, among others, have provided tremendous value to their users.

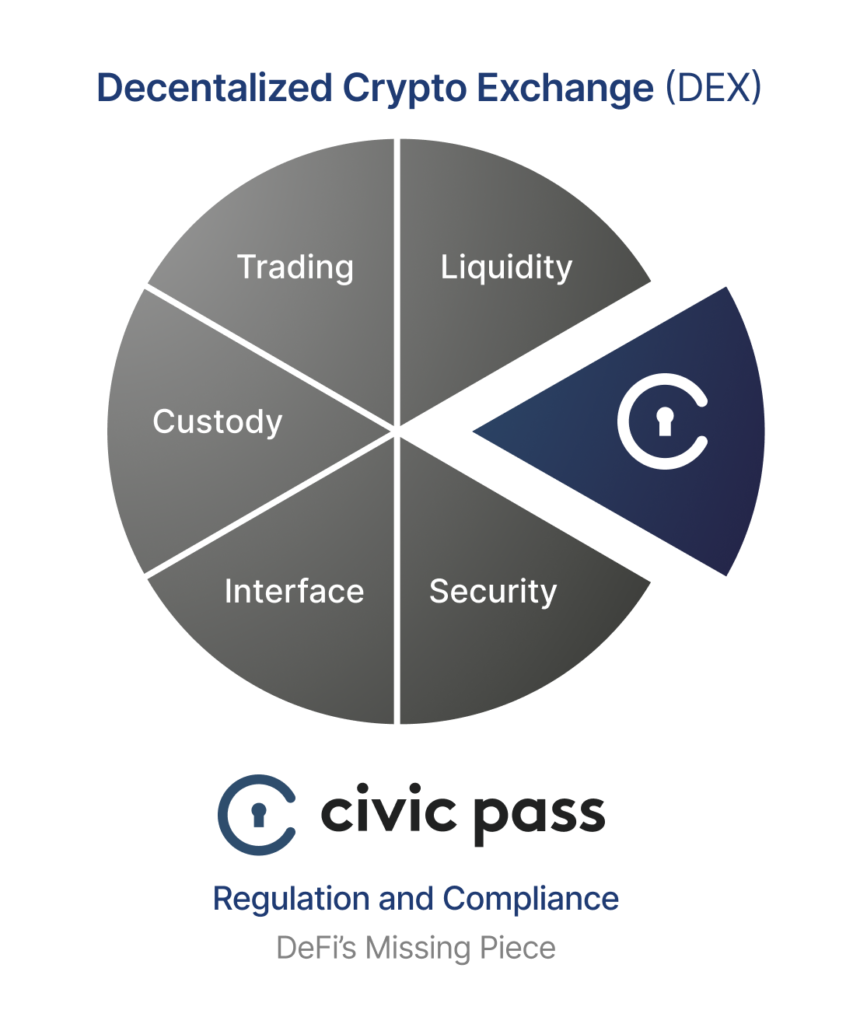

DeFi’s thesis is particularly well suited to replacing important aspects of the centralized finance stack: trading logic (smart contracts / protocols), custody (non-custodial wallets), and security (on-chain elimination of counterparty risk / auditable contracts):

However, in other important ways the rules remain the same for compliance, regulatory oversight and capital markets. The argument goes that it remains crucial to ensure basic safeguards remain in place to curtail bad actors and to provide guardrails for retail investors for whom loss of funds could be monumental.

What is clear, is that the days of treating regulatory compliance as irrelevant to DeFi, or imagining that somehow the blockchain paradigm exempts the new breed of Fintechs from basic checks like KYC, are coming to a close.

It is true that the more complicated offerings like derivatives (i.e. futures, options) and high leverage trading require a degree of sophistication, but should elite banks decide who gets to participate? And why should those traders and investors who want to participate in DeFi be blocked from doing so, assuming appropriate guardrails are in place? At Civic we believe in the power of DeFi and the more level playing field it provides.

Is there a way to get the best of both worlds?

There are good reasons why KYC and AML guidelines need to be followed. However, until now the process of disintermediation of the traditional financial services stack has not allowed for both DeFi structures and compliance frameworks to enable the next wave of innovation.

Civic and our partners are working to change that with the introduction of Civic Pass:

With Civic Pass, our partners can move towards meeting KYC & AML requirements with Civic’s SaaS compliance tools. These tool allows for participation with known counterparties and permissioned DeFi pools of liquidity.

Ultimately, Civic’s vision is to provide the identity and compliance piece of the DeFi puzzle. We want to enable the complete disintermediation of CeFi and, more broadly, foster the adoption of identity and compliance structures for any on-chain project that needs them.

At Civic we believe that the power of decentralization can be coupled with an on-chain identity layer in a way that adheres to regulatory requirements, accelerates the pace of innovation, enables the next 100 innovative blockchain companies and protects individual privacy. Civic is excited to continue to work with these innovators and regulators as we work towards true decentralization of the DeFi governance layer.

If you want to get a glimpse of what that future looks like, check out the first implementation of the Civic Pass solution with our launch partner.

Want to learn more about partnering with Civic? Get in touch here.

Chris Hart

CEO